The development of new energy vehicles drives the enthusiasm of the rare earth market

Recently, when the prices of all domestic bulk commodities and non-ferrous metal bulk commodities are falling, the market price of rare earths has been thriving, especially at the end of October, where the price span is wide and the activity of traders has increased. For example, spot praseodymium and neodymium metal is hard to find in October, and high-priced purchases have become the norm in the industry. The spot price of praseodymium neodymium metal reached 910,000 yuan/ton, and the price of praseodymium neodymium oxide also maintained a high price of 735,000 to 740,000 yuan/ton.

Market analysts said that the increase in rare earth prices is mainly due to the combined effects of current increased demand, reduced supply and low inventories. With the arrival of the peak order season in the fourth quarter, rare earth prices still have upward momentum. In fact, the reason for this increase in rare earth prices is mainly driven by the demand for new energy. In other words, the rise in rare earth prices is actually a ride on the new energy.

According to relevant statistics, in the first three quarters of this year, my country’s new energy vehicle sales reached a new high. From January to September, the sales volume of new energy vehicles in China was 2.157 million, a year-on-year increase of 1.9 times and a year-on-year increase of 1.4 times. 11.6% of the company’s new car sales.

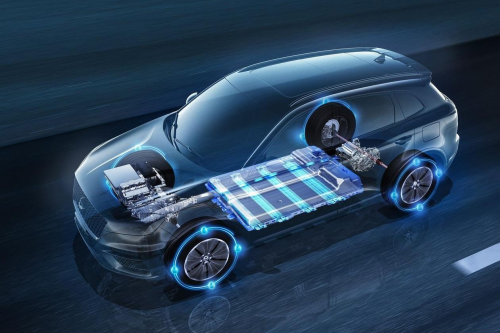

The development of new energy vehicles has greatly benefited the rare earth industry. NdFeB is one of them. This high-performance magnetic material is mainly used in the fields of automobiles, wind power, consumer electronics and so on. In recent years, the market’s demand for NdFeB has increased significantly. Compared with the changes in the consumption structure in the past five years, the proportion of new energy vehicles has doubled.

According to the introduction by American expert David Abraham in the book “Periodic Table of Elements”, modern (new energy) vehicles are equipped with more than 40 magnets, more than 20 sensors, and use nearly 500 grams of rare earth materials. Each hybrid vehicle needs to use up to 1.5 kilograms of rare earth magnetic materials. For major automakers, the currently evolving chip shortage is actually just the fragile shortcomings, shorter ones, and possibly “rare earths on wheels” in the supply chain.

Abraham’s statement is not an exaggeration. The rare earth industry will play an increasingly important role in the development of new energy vehicles. Such as neodymium iron boron, it is an indispensable part of new energy vehicles. Looking further upstream, neodymium, praseodymium and dysprosium in rare earths are also important raw materials for neodymium iron boron. The prosperity of the new energy vehicle market will inevitably lead to an increase in demand for rare earth materials such as neodymium.

Under the goal of carbon peak and carbon neutrality, the country will continue to increase its policies to promote the development of new energy vehicles. The State Council recently issued the “Carbon Peaking Action Plan in 2030″, which proposes to strongly promote new energy vehicles, gradually reduce the share of traditional fuel vehicles in new vehicle production and vehicle holdings, promote electrified alternatives to urban public service vehicles, and promote electricity and hydrogen. Fuel, liquefied natural gas powered heavy-duty freight vehicles. The Action Plan also clarified that by 2030, the proportion of new energy and clean energy-powered vehicles will reach 40%, and the carbon emission intensity per unit weekly conversion of operating vehicles will be reduced by 9.5% compared with 2020.

This is a major benefit to the rare earth industry. According to estimates, new energy vehicles will usher in explosive growth before 2030, and my country’s auto industry and auto consumption will rebuild around new energy sources. Hidden behind this macro goal is the huge demand for rare earths. The demand for new energy vehicles has already accounted for 10% of the demand for high-performance NdFeB products, and about 30% of the demand increase. Assuming that the sales of new energy vehicles will reach about 18 million in 2025, the demand for new energy vehicles will increase to 27.4%.

With the advancement of the “dual carbon” goal, the central and local governments will vigorously support and promote the development of new energy vehicles, and a series of support policies will continue to be released and implemented. Therefore, whether it is the increase in investment in new energy in the process of implementing the “dual carbon” goal, or the boom in the new energy vehicle market, it has brought a huge increa