Analysis of price increase of medium and heavy rare earth products

Analysis of price increase of medium and heavy rare earth products

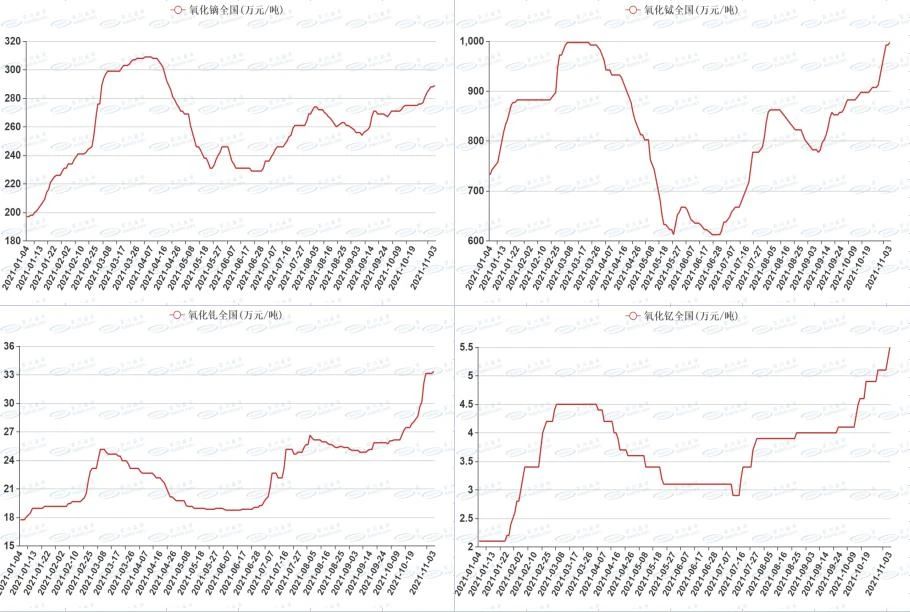

Prices of medium and heavy rare earth products continued to rise slowly, with dysprosium, terbium, gadolinium, holmium and yttrium as the main products. Downstream inquiry and replenishment increased, while upstream supply continued to be in short supply, supported by both favorable supply and demand, and the transaction price continued to move up at a high level. At present, more than 2.9 million yuan/ton of dysprosium oxide has been sold, and more than 10 million yuan/ton of terbium oxide has been sold. Yttrium oxide prices have risen sharply, and downstream demand and consumption have continued to increase.Especially in the new application direction of fan blade fiber in wind power industry, the market demand is expected to continue to grow. At present, the quoted price of yttrium oxide factory is about 60,000 yuan/ton, which is 42.9% higher than that in early October. The price increase of medium and heavy rare earth products continued, which was mainly affected by the following aspects:

1. raw materials are reduced. Myanmar mines continue to restrict imports, resulting in tight supply of rare earth mines in China and high ore prices. Some medium and heavy rare earth separation enterprises do not have raw ore, resulting in a decline in the operating rate of production enterprises. However, the output of gadolinium holmium itself is low, the inventory of manufacturers continues to be low, and the market spot is seriously insufficient. Especially for dysprosium and terbium products, the inventory is relatively concentrated, and the price increases obviously.

2. Limit electricity and production. At present, power cut notices are issued in different places, and the specific implementation methods are different. The production enterprises in the main producing areas of Jiangsu and Jiangxi have stopped production indirectly, while other regions have reduced production to varying degrees. The supply in the market outlook is becoming tighter, the mentality of merchants is supported, and the supply of low-priced goods is reduced.

3. Increased costs. The prices of raw materials and other products used by separation enterprises have risen. As far as oxalic acid in Inner Mongolia is concerned, the current price is 6400 yuan/ton, an increase of 124.56% compared with the beginning of the year. The price of hydrochloric acid in Inner Mongolia is 550 yuan/ton, an increase of 83.3% compared with the beginning of the year.

4. Strong bullish atmosphere. Since the National Day, the downstream demand has increased obviously, the orders of NdFeB enterprises have improved, and under the mentality of buying up instead of buying down, there is concern that the market outlook will continue to rise, the terminal orders may appear ahead of time, the mentality of the merchants is supported, the spot shortage continues, and the bullish sentiment of reluctance to sell increases. Today,The National Development and Reform Commission and the National Energy Administration issued a notice on carrying out the transformation and upgrading of coal-fired power units nationwide: coal saving and consumption reduction transformation. Rare-earth permanent magnet motor has obvious effect on reducing power consumption load, but its market penetration rate is low. It is expected that the growth rate will be faster under the general trend of carbon neutralization and energy consumption reduction. Therefore, the demand side also supports the price of rare earths.

To sum up, raw materials are insufficient, costs are rising, supply increment is small, downstream demand is expected to increase, market sentiment is strong, shipments are cautious, and rare earth prices continue to rise.